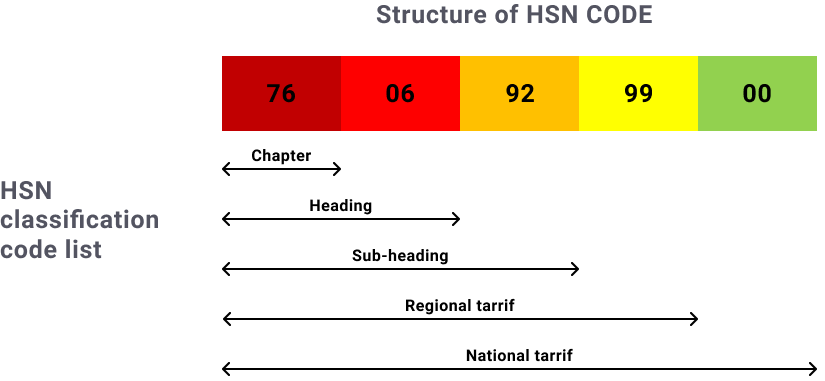

Chapter Heading Sub-heading Tariff item.

Washing machine hsn code gst rate. You can search GST tax rate for all products in this search box. Our Washing machine hose import data and export data solutions meet your actual import and export requirements in quality volume seasonality and geography. The GST tariff rate on goods under HSN 8450 has been Revised as per GST council meet held on 21st July 2018.

Fixed by GST council at the introduction of GST in July 2017 is 28. Machines which both wash and dry. You can search GST tax rate for all products in this search.

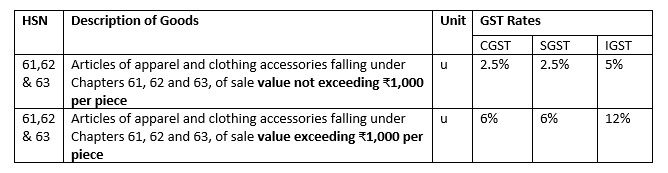

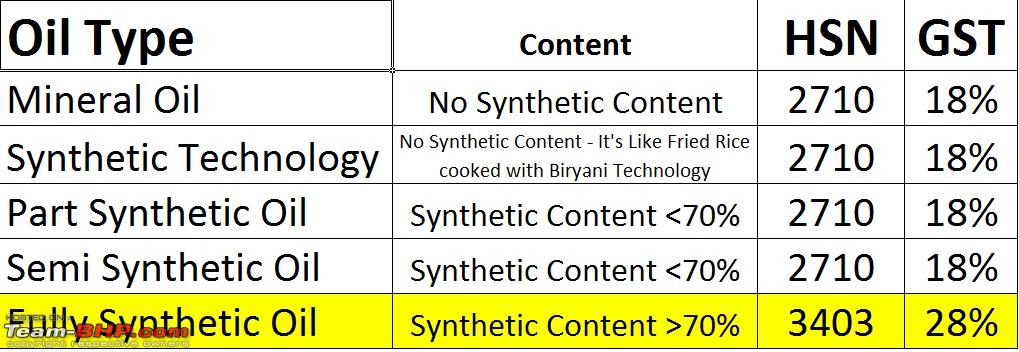

7 rows GST rates for all HS codes. Kindly consult the professional before forming any opinion. GST Rates HSN Codes for Electrical And Electronic Products - Electric motors and generators Electric generating sets Transformers Industrial Electronics - Chapter 85.

Sorting screening separating or washing machines for. GST rates for all HS codes. Parts of machines for washing cleaning wringing drying ironing pressing bleaching dyeing dressing finishing coating or impregnating textile yarns fabrics or made-up textile articles.

Tax rates are sourced from GST. Alongside we help you get detailed information on the vital export and import fields that encompass HS codes product description duty quantity price etc. Machinery for capsuling bottles jars tubes and similar containers.

HS Code is internationally accepted format of coding to describe a product. While most electronics are taxed at 18 others such as dishwashing machines digital cameras and air conditioners are taxed at 28 GST on home appliances indicating that the governments philosophy is to tax luxury items at a higher rate. Tax rates are sourced from GST.