By year six the IRS will deem the asset to have only depreciated by 576 percent resulting in just a 74 deduction.

Depreciation rate on washing machine. Download the BMT Rate Finder app today and search depreciation rates on the go. You can calculate this value yourself with a few pieces of information about the machine and quickly identify how much it has depreciated over the course of the year or its entire life. For most depreciating assets you can use the ATOs determinations of effective life published in taxation rulings updated annually.

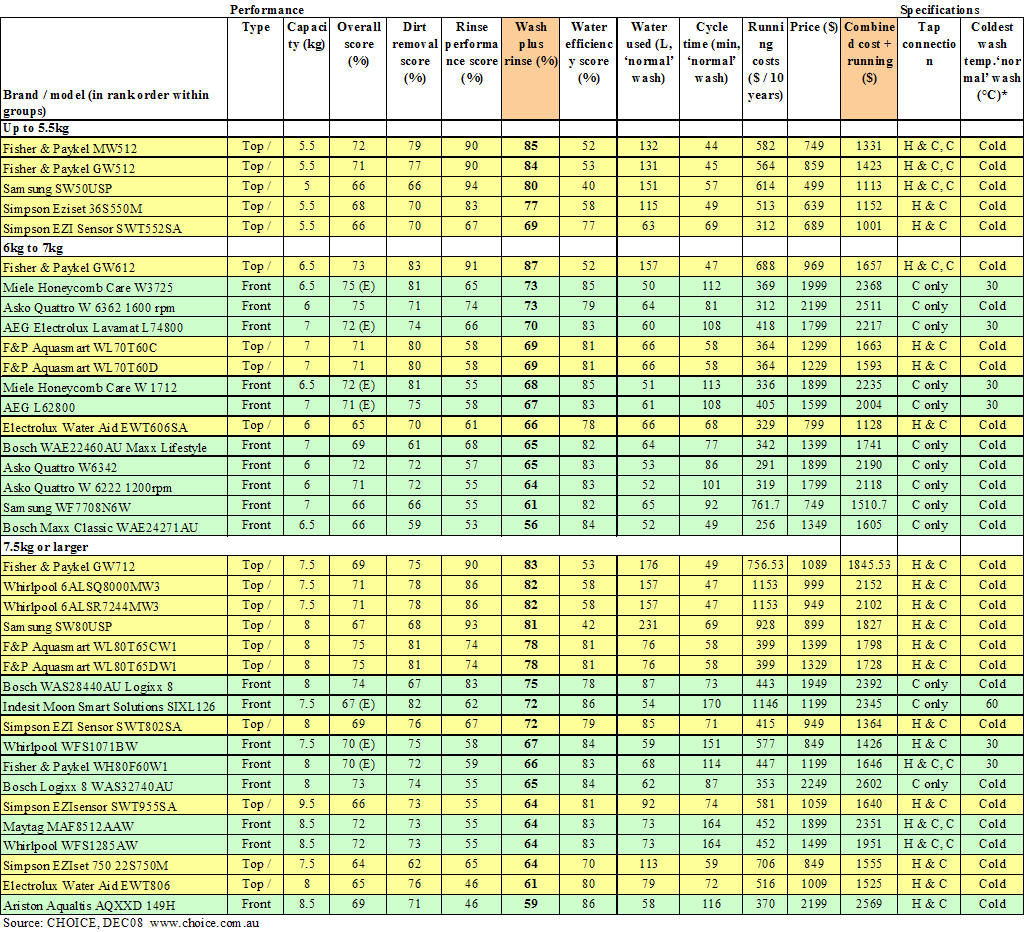

The annual depreciation rate of the washing machine using the prime cost method is. The percentage of the machine that is worn out each year is referred to as depreciation. Plant and equipment assets with changed effective lives in TR 20195.

Remember the factory equipment is expected to last five years so this is how your calculations would look. Appliances - Major - Washer Depreciation Rate. Now Than purchases a few appliances for his rental property at the same time.

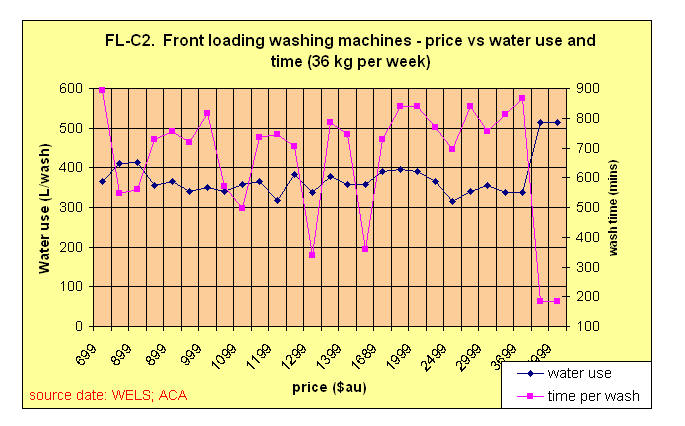

Depreciation rates are based on the effective life of an asset unless a write-off rate is prescribed for some other purpose such as the small business incentives. The depreciation expense is the rate of an assets decrease in value over a given period of time. Some items may devalue more rapidly due to consumer preferences or technological advancements.

85 rows Diminishing Value Rate Prime Cost Rate Date of Application. Applicable from the Assessment year 2004-05. Depreciation rate washing machine per income tax act 1961 Income Tax Goods and services Tax GST Service Tax Central Excise Custom Wealth Tax Foreign Exchange.

The effective life is used to work out the assets decline in value or depreciation for which an income tax deduction can be claimed. Using this method the depreciation amounts will look something like this. The Depreciation Guide document should be used as a general guide only.

)