A Tax Depreciation Schedule is a professionally produced document highlighting items of plant equipment and capital costs that may be depreciated.

Depreciation of washing machine. What is a Tax Depreciation Schedule. The depreciation expense is the rate of an assets decrease in value over a given period of time. For some types of transport and agricultural machinery and gas.

Go online to the IRS website and download the IRS publication that gives information on how to depreciate assets. Hands down the top credit card of 2021. And the depreciation amount each year is calculated off the washing machines cost.

990 rows Degreasing machine s including washing machine s 7 years. Some items may devalue more rapidly due to consumer preferences or technological advancements. 97 rows 2000.

Appliances major washer automatic kenmore ge maytag frigidaire hotpoint thompson carrier aircon videocon samsung whirlpool national bluestar hitachi. Accountants and business owners use the depreciation expense to account for the value of an asset during its useful life. Remember the factory equipment is expected to last five years so this is how your calculations would look.

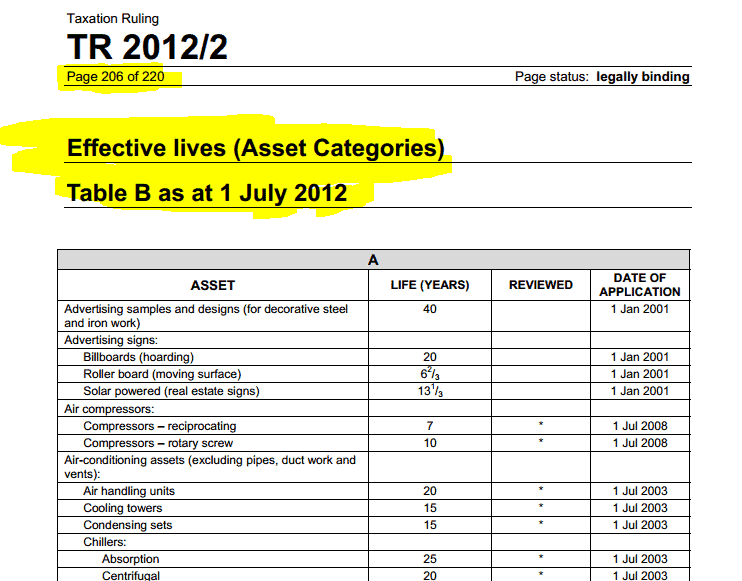

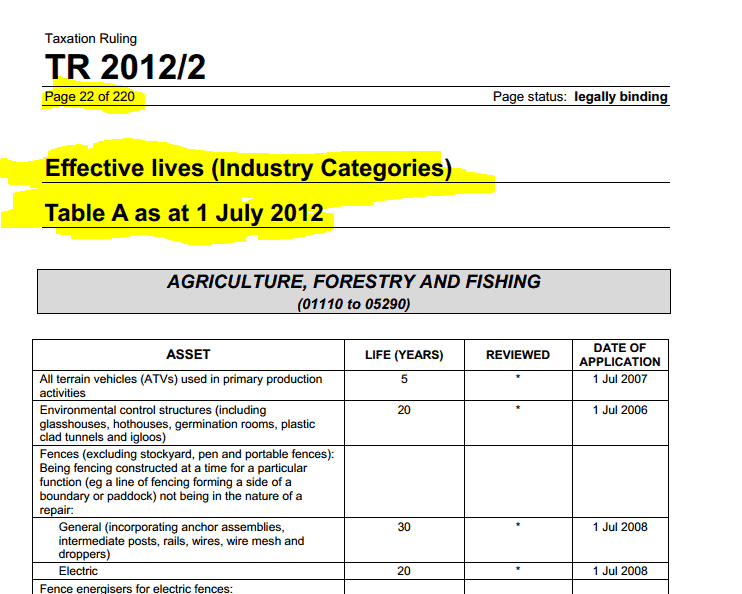

Following the prompts for rental property appliances carpet furnishings listed as an example under the Tools Machinery Equipment Furniture selection resulted in a 7 year vs 5 year depreciation for my rental property appliance. Along with the new assets some existing assets have reduced effective lives outlined in TR 20195 include television sets telephone handsets microwave ovensspa bath pumps dishwashers washing machines clothes dryers solar garden lights freestanding bathroom accessories and carpet. The effective life is used to work out the assets decline in value or depreciation for which an income tax deduction can be claimed.

Divide 100 by the number of years in the asset life and then multiply by 2 to find the depreciation rate. When you buy that washing machine and continue to use it for ten years ten years is the useful life of the asset washing. An item like a washing machine is depreciated over a 7 year period.